If i max out my 401k calculator

The IRS allows each person to contribute 19500 to their 401k account up until age 50. Even if you dont max out your 401k you can still maximize your savings.

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Retirement Planning Good Credit

After age 50 you are able to contribute a total of 26000 each year.

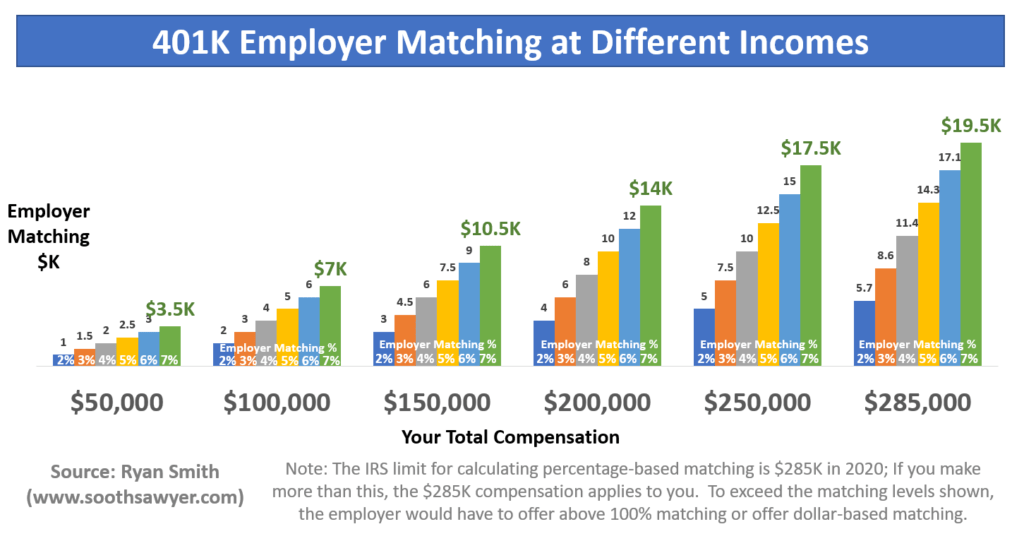

. If this employee earned 60000 the employer would contribute a maximum of 1800 to the. Even if you dont max out your 401k you can still maximize your savings. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings.

Find your 401k projections with our calculator to get an estimate of the value of your 401k retirement account and get a personalized report. One opportunity your workplace might offer is a match contribution program. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement.

It provides you with two important advantages. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. So in effect they will contribute a.

Step 3 Now determine the duration which is left from current age till the age of. This calculator below tells you what percentage. Step 1 Determine the initial balance of the account if any.

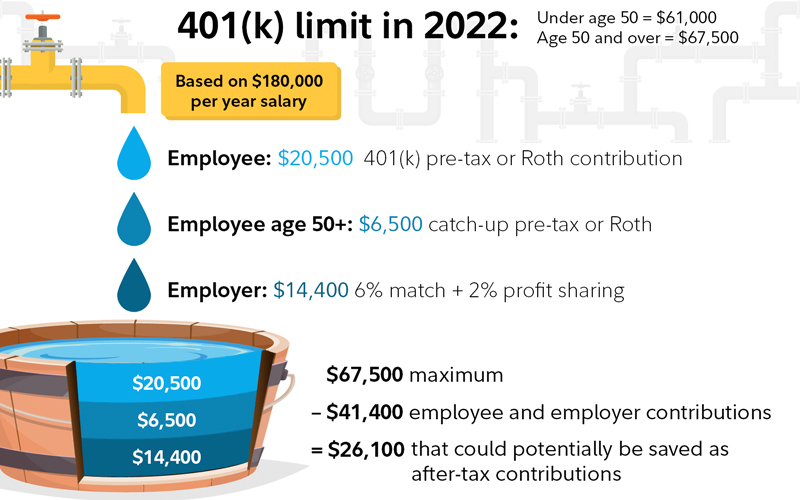

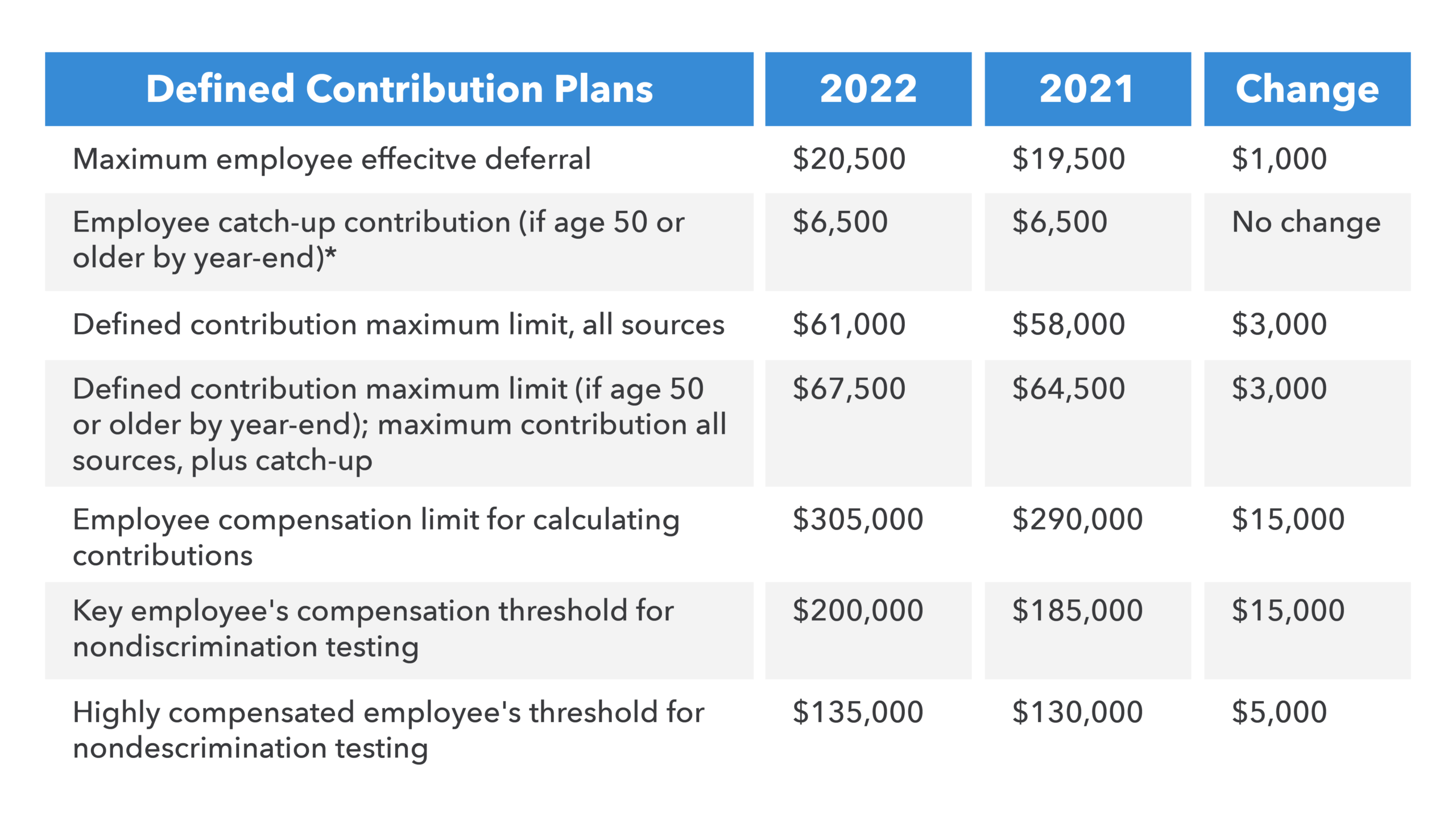

How do I calculate my 401k max. For example an employer may match up to 3 of an employees contribution to their 401 k. To max out a 401 k for 2022 an employee would need to contribute 20500 in salary deferralsor 27000 if theyre over age 50.

Doing the math on the different. Select a state to. After not being able to find any calculator or formula online for what I was looking for I decided to sit down and create my own.

The good news is employer contributions do not. 401k Contribution Calculator To Max Out If you get paid twice per month that works out to be a total. Calculator to see how increasing your contributions to a 401k can affect your paycheck and.

We use the current maximum contributions 18000 in 2015. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and. 20000 or 20000Current 401 k Balance 50000 or 50000Current Annual Income 3Expected Annual Salary Increase 6Percent of Salary Withheld for 401 k Monthly box selected 100 and 6 respectivelyEmployer Match Annually box selected 10Years to Fund 401 k 11Average Annual Interest Rate Earned Annually box selected.

Some investors might think about maxing. Employees are allowed to contribute a maximum of 19500 to their 401 in 2020 or 26000 if youre over 50 years of age. Wed suggest using that as your primary retirement account.

Individuals over the age of 50 can contribute an additional 6500 in catch-up. How To Max Out A 401k For 2021 the 401k contribution limit is 19500 in salary deferrals. State Date State Federal.

Learn About 2021 Contribution Limits Today. How do I calculate my 401k max. Also a fixed periodical amount will be invested in the 401 k Contribution which would be a maximum of 19000 per year.

You can contribute up to 20500 in 2022 with an additional 6500 as a. If you have a 401k or other retirement plan at work. Titans 401 k calculator gives anyone the ability to project potential returns from a 401 k retirement fund based on your current age 401 k balance and annual salary.

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

After Tax 401 K Contributions Retirement Benefits Fidelity

How Much Should I Have Saved In My 401k By Age

How Much Should I Have Saved In My 401k By Age

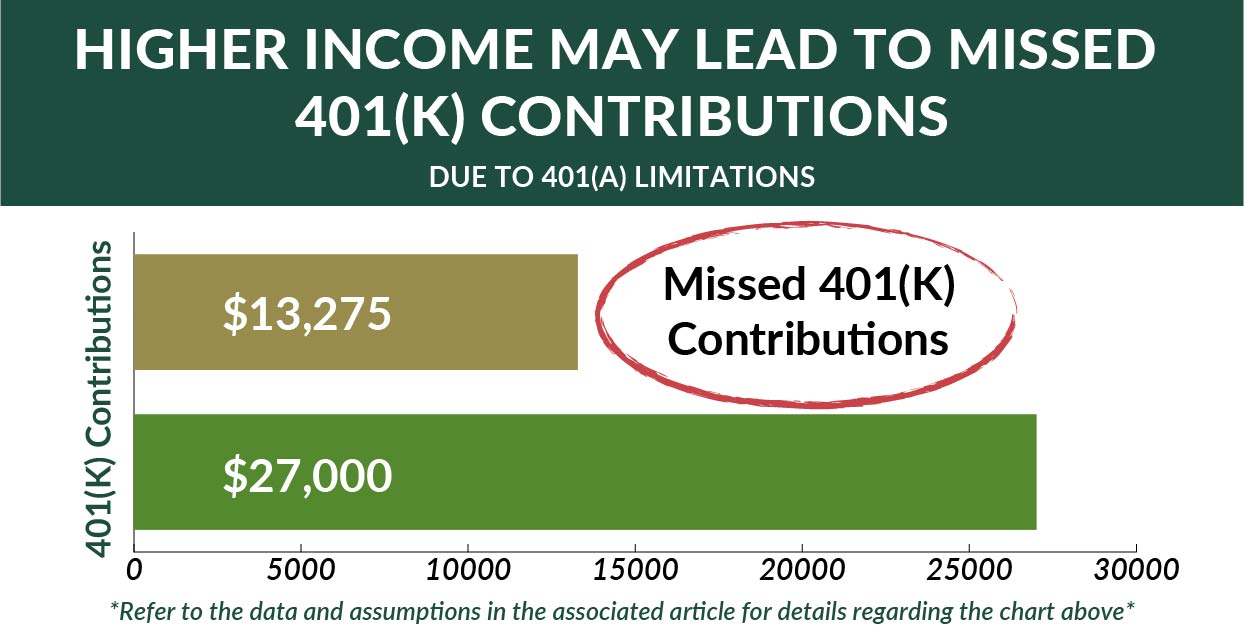

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

Roth Ira Vs 401 K Roth Ira Calculator Stashing Dollars Roth Ira Roth Ira

The Maximum 401k Contribution Limit Financial Samurai

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

Maxing Out My 401 K While Earning 55 000 In Washington Dc Tax Refund Income Budgeting

How Much Should People Have Saved In Their 401ks At Different Ages See More At Http Www Financialsamura Saving For Retirement 401k Chart Finance Education

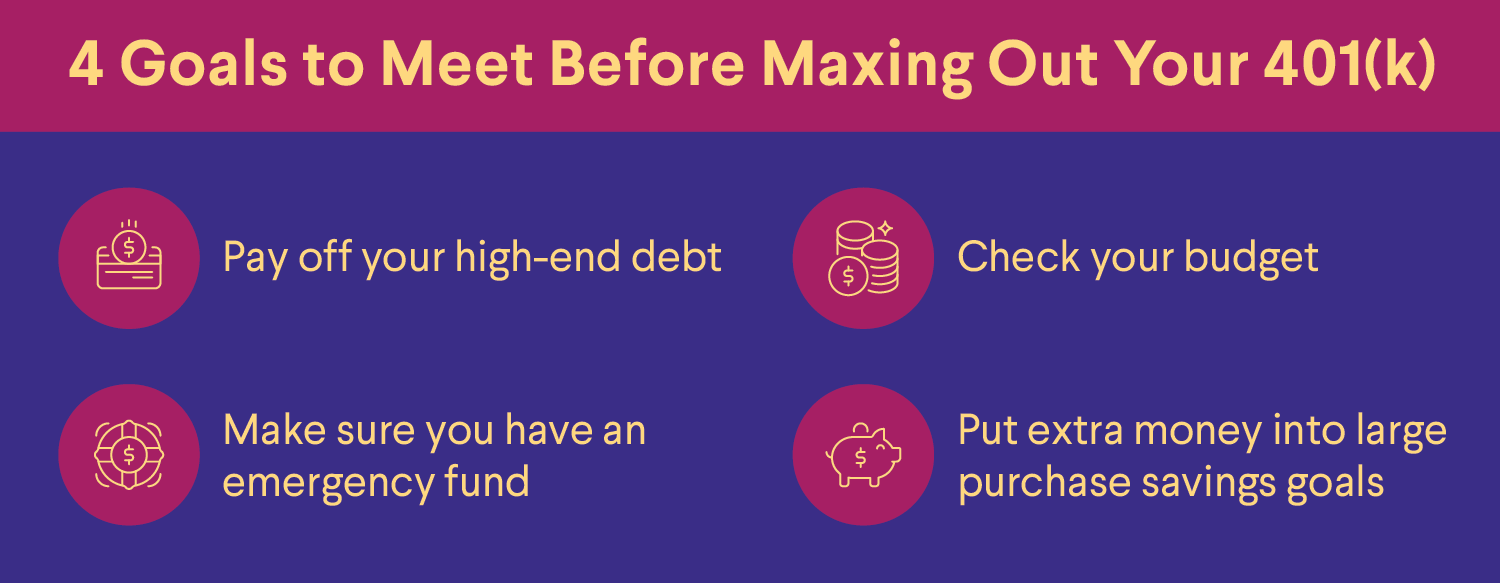

Should I Max Out My 401k Ally

401 K Plan What Is A 401 K And How Does It Work

How Much Should I Have Saved In My 401k By Age

How Much Should I Have Saved In My 401k By Age

6 Steps To Max Out A 401 K What To Do After Maxing Out Sofi